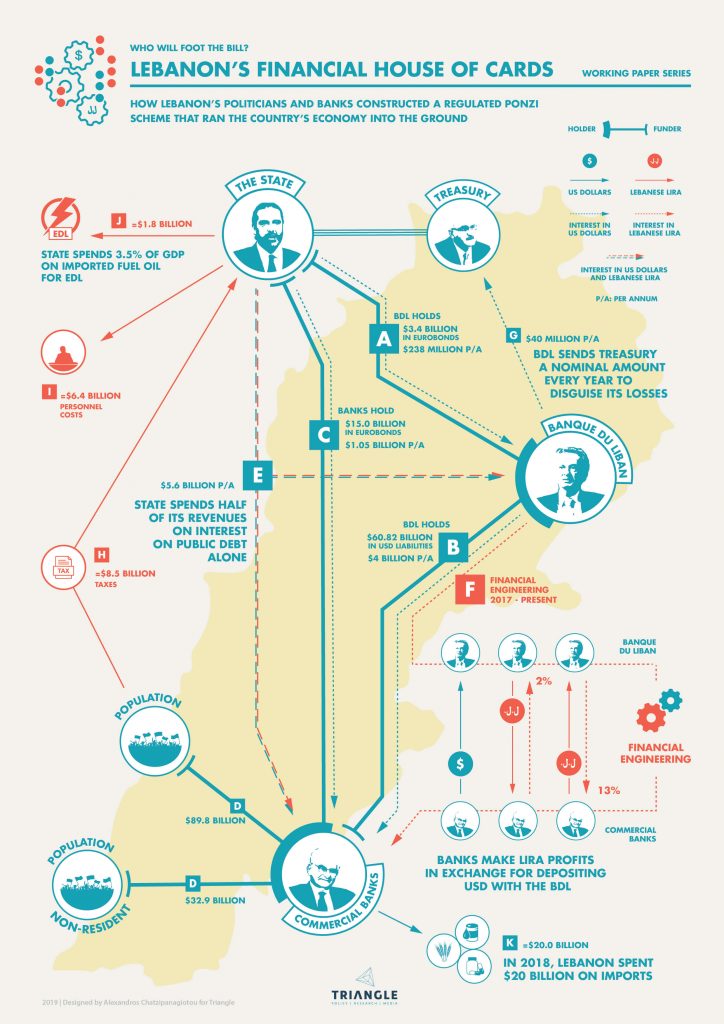

The first installment of Triangle’s new working paper series ‘Who Will Foot the Bill?,’ examines the financial Ponzi scheme that pushed Lebanon’s economy to the brink of collapse. The policy paper reveals how Lebanon’s reliance on banking, tourism, and real estate drew in foreign dollars that were mismanaged by the state, commercial banks, and the Banque du Liban. This mismanagement led to the collapse of the financial system when new foreign investments ceased, precipitating significant economic and social challenges.

The policy paper outlines crucial reforms needed to restore stability and build a more sustainable economic model. Recommendations include implementing progressive financial measures, adjusting the currency peg through a managed float of the Lira, and transitioning towards a civil state framework to support sustainable growth and leverage Lebanon’s human and geographical assets. These steps aim to foster a rational and equitable economic future for Lebanon, averting further crises.